Summary: people take more risks when confronted with a certain loss than when confronted with a certain gain, even when the situations are equivalent.

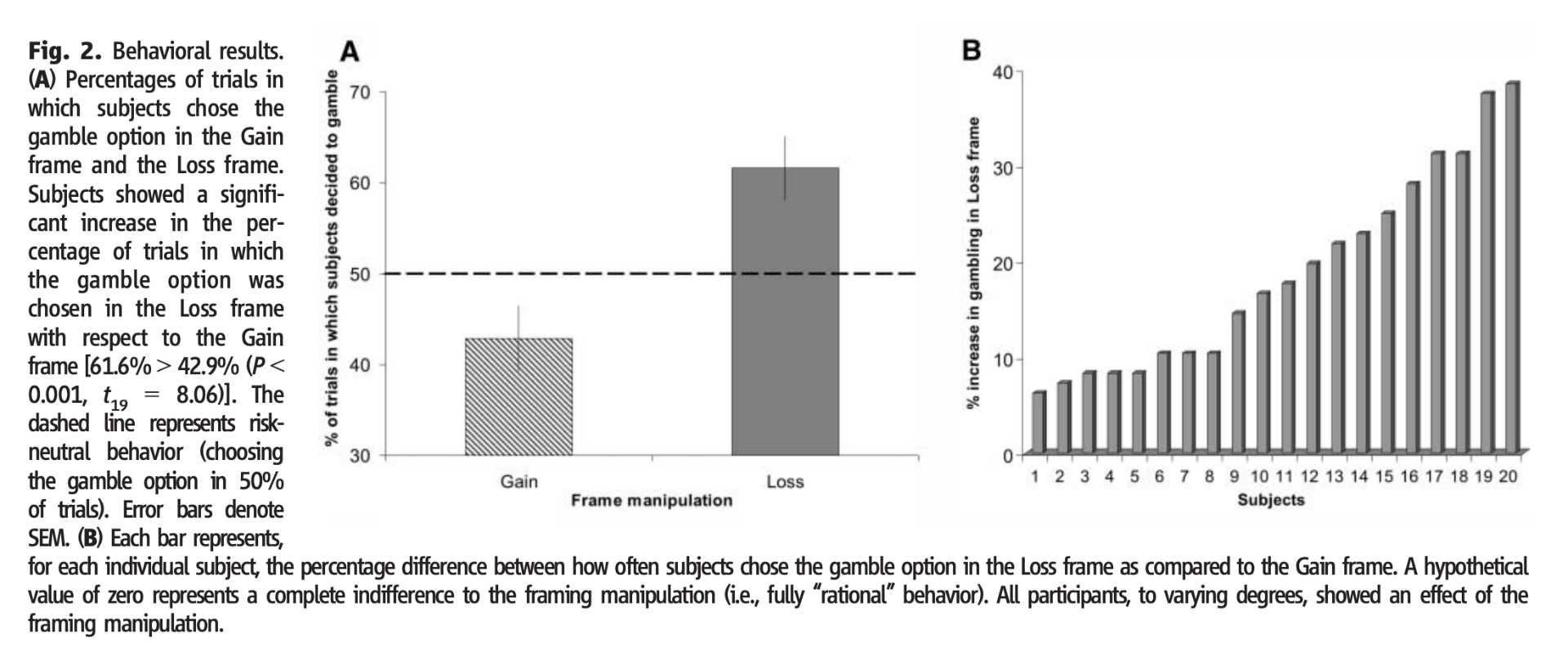

Participants received a message indicating the amount of money that they would initially receive in that trial (e.g., “You receive $50”). Subjects then had to choose between a “sure” option and a “gamble” option presented in the context of two different frames. The “sure” option was formulated as either the amount of money retained from the initial starting amount (e.g., keep $20 of the $50; “Gain” frame) or as the amount of money lost from the initial amount (e.g., lose $30 of the $50; “Loss” frame). The “gamble” option was identical in both frames and was represented as a pie chart depicting the probability of winning or losing. The behavioral results indicated that subjects’ decisions were significantly affected by our framing manipulation, with a marked difference in choices between the two frames. Specifically, and in accordance with predictions arising from prospect theory, subjects were risk-averse in the Gain frame, tending to choose the sure option over the gamble option, and were risk-seeking in the Loss frame, preferring the gamble option. This effect of frame was consistently expressed across different probabilities and starting amounts.

Behavioral results